is there a death tax in texas

No not every state imposes a death tax. The estate tax sometimes.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15.

. In 2011 estates are exempt from paying taxes. Cons of death tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

There is a Federal estate tax that applies to estates worth more than 117 million. However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased after. It is one of 38 states that do not have an estate tax.

Estate tax is only levied on property that. There is a Federal estate tax that applies to estates worth more than 117 million. Call our estate planning attorneys to learn more.

There is a 40 percent federal. Is there a death tax in texas. There would be no tax due on the first spouses death.

In short there is no gift tax in Canada. Estate Tax in Texas. Although theres no estate tax in Texas you still might have to pay federal estate taxes.

Prior to September 15 2015 the tax was tied to the. Trump Organizations criminal tax fraud trial kicks off today as prosecutors claim the firms chiefs ran a 15-year scheme to avoid taxes. The death tax is only hitting the wealthiest Americans.

While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. Is There A Death Tax In Texas. Texas mom shoots and wounds burglar.

The vast majority of us more than 99 wont stand to ever pay an estate tax. Death Taxes in Texas. The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow.

The federal estate tax is a tax on property cash real estate stock or other assets transferred from deceased persons to their heirs. Like the inheritance tax there is no estate tax in Texas. While there are no direct taxes on death family members must understand certain tax rules to avoid a significant tax bill.

If you as a Canadian resident receive a gift you do not have to report it to the CRA and there shouldnt be any tax implications. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015. This final tax isnt anything that you or your estate would be.

Book a Consultation 512 410-0343. The taxes plus interest plus a penalty keep adding up until the elderly or disabled homeowner dies. Then the estate must pay the taxes interest and penalties.

The federal estate tax is a tax on your right to transfer property at your. There is a 40 percent federal tax however on estates over 534. When a person dies and their.

The big question is if there are. Federal exemption for deaths on or after January 1 2023. Only 12 states plus the District of Columbia impose an estate.

What Is the Estate Tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas does not carry the death sentence for any other crimes.

Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015. Pin On Family Law UT ST 59-11-102. For the tax year.

Exploring The Estate Tax Part 1 Journal Of Accountancy

Taxes On Selling A House In Texas What Are The Taxes To Sell My Home

Estate Inheritance Taxes In Texas Vs California

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Seniors Can Stop Paying Property Taxes In Texas

Death Tax In Texas Estate Inheritance Tax Law In Tx

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

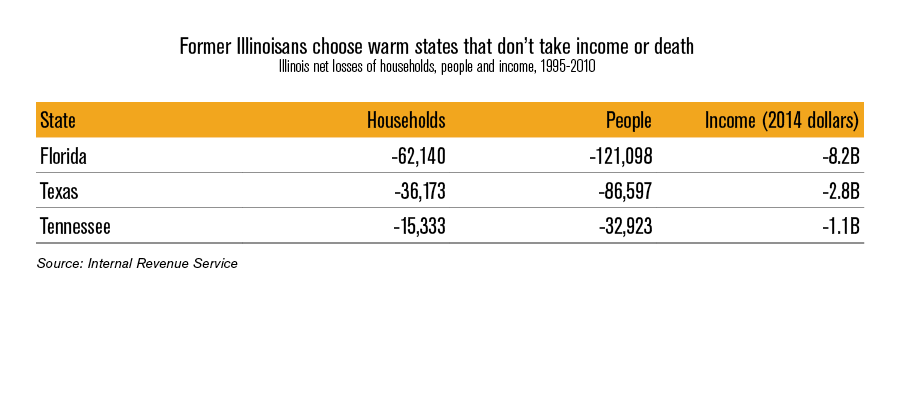

Illinois Should Repeal The Death Tax

Illinois Should Repeal The Death Tax

Is There An Inheritance Tax In Texas

Does Texas Have An Inheritance Tax Rania Combs Law Pllc

A Guide To The Federal Estate Tax For 2022 Smartasset

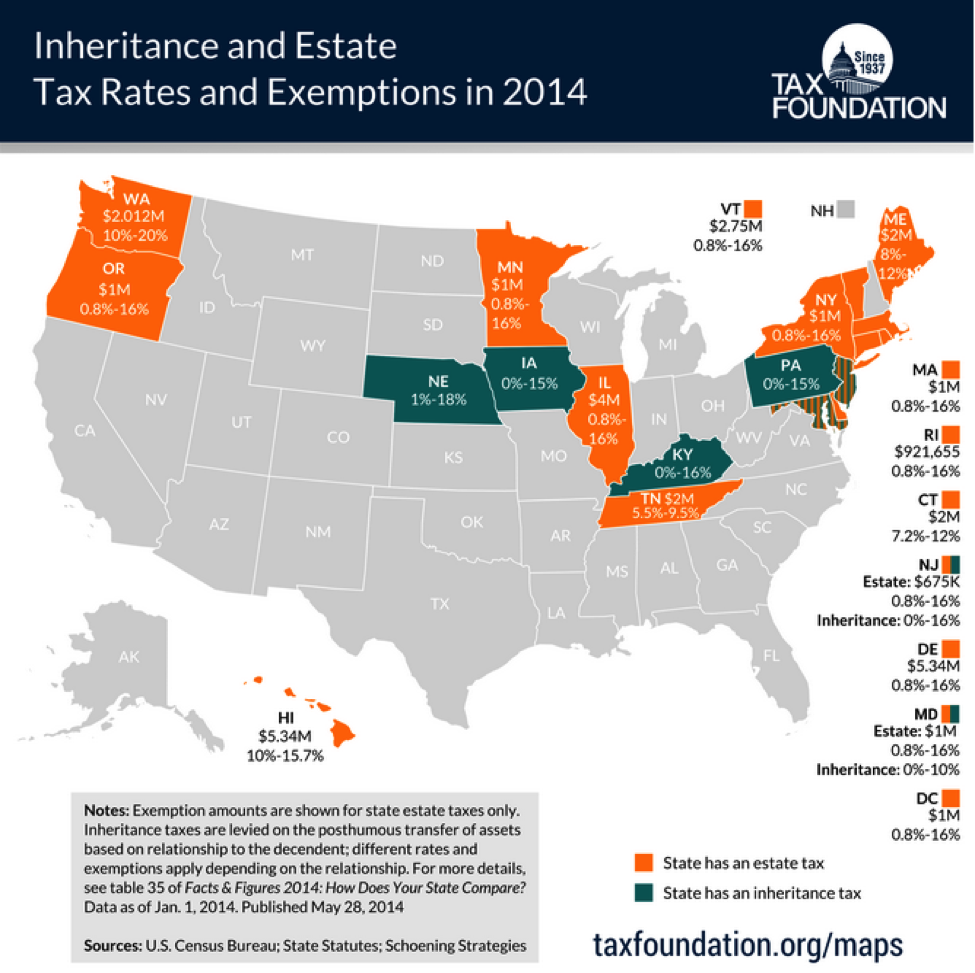

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Highest Property Taxes In Texas Why Are Property Taxes So High In Texas Tax Ease

Transfer On Death Tax Implications Findlaw

Republicans Say Death Tax While Democrats Say Estate Tax

When Are Property Taxes Due In Texas Find The Texas Property Tax Due Dates More Tax Ease

States With No Estate Tax Or Inheritance Tax Plan Where You Die